No Data

US OptionsDetailed Quotes

VG250516P17500

- 9.00

- 0.000.00%

15min DelayTrading Apr 28 12:36 ET

0.00High0.00Low

0.00Open9.00Pre Close0 Volume21 Open Interest17.50Strike Price0.00Turnover357.11%IV-1.55%PremiumMay 16, 2025Expiry Date9.13Intrinsic Value100Multiplier16DDays to Expiry0.00Extrinsic Value100Contract SizeAmericanOptions Type-0.7278Delta0.0531Gamma0.85Leverage Ratio-0.0634Theta-0.0057Rho-0.62Eff Leverage0.0058Vega

Intraday

- 5D

- Daily

News

Venture Global Is Maintained at Buy by B of A Securities

Express News | Venture Global Inc : BofA Global Research Cuts Price Objective to $12 From $14

LNG Companies Say Impossible to Comply With Trump Rules on Chinese Ships - FT

Express News | U.S. Natural Gas Futures Extend Gains, Price up by 5% in Light Trade Ahead of Front-Month Contract Expiration

SA Asks: When Will the IPO Market Finally Pick Up?

Express News | JP Morgan Maintains Overweight on Venture Global, Lowers Price Target to $15

Comments

$Venture Global (VG.US)$ April 23, 2025

📊 Overview

Current price: $8.97

Daily change: +$0.37 (+4.30%)

Intraday range: $8.68 – $9.41

Volume: 3,303,771 shares

Market capitalization: $20.81 billion

Beta: 2.45 (very high volatility compared to the market)

---

🗓️ Monthly Analysis

Moving averages:

200 MA: $9.63 (the price is currently below it, indicating a long-term bearish trend)

Technical indicators:

RSI (14): 55.93 – in neutral territory, showing no extreme m...

📊 Overview

Current price: $8.97

Daily change: +$0.37 (+4.30%)

Intraday range: $8.68 – $9.41

Volume: 3,303,771 shares

Market capitalization: $20.81 billion

Beta: 2.45 (very high volatility compared to the market)

---

🗓️ Monthly Analysis

Moving averages:

200 MA: $9.63 (the price is currently below it, indicating a long-term bearish trend)

Technical indicators:

RSI (14): 55.93 – in neutral territory, showing no extreme m...

6

4

$Venture Global (VG.US)$

April 16, 2025

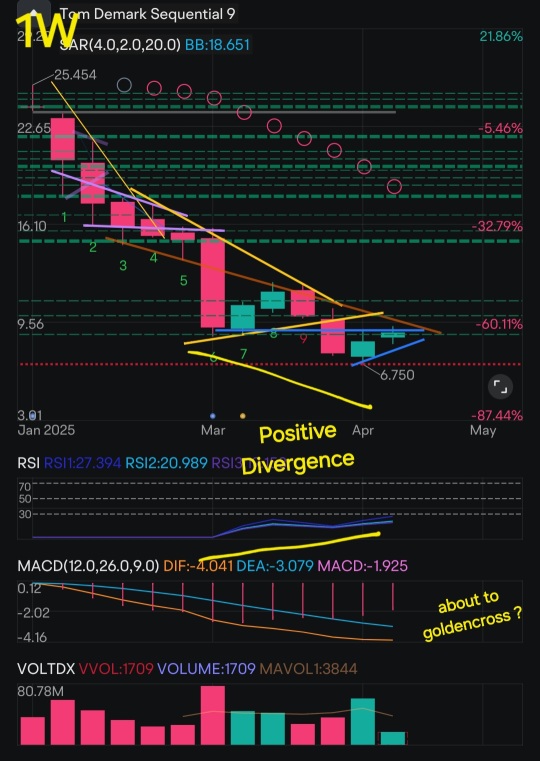

Multi-Timeframe Technical Analysis:

1. MULTI-TIMEFRAME STRUCTURAL CONTEXT

Monthly: Since its IPO at $25, the stock has shown a strong bearish trend. No clear reversal structure has formed. The monthly chart shows a series of red candles with no significant rebound, indicating an ongoing distribution cycle.

Weekly: The stock is evolving within a descending channel. Rebounds are consistently rejected ...

April 16, 2025

Multi-Timeframe Technical Analysis:

1. MULTI-TIMEFRAME STRUCTURAL CONTEXT

Monthly: Since its IPO at $25, the stock has shown a strong bearish trend. No clear reversal structure has formed. The monthly chart shows a series of red candles with no significant rebound, indicating an ongoing distribution cycle.

Weekly: The stock is evolving within a descending channel. Rebounds are consistently rejected ...

22

6

$Venture Global (VG.US)$ dun understand how VG can lose so much ground... Does it even have a bottom???

Read more

Keiith : Given that the long - term technical trend for Venture Global is bearish but short - term signals are bullish, how do you balance these conflicting indicators when deciding on an investment strategy?

Handiyanan : I really appreciate how comprehensive this analysis is.

But I'm curious about how the author weights different factors when making an overall assessment. For example, are the legal disputes more of a concern than the competition in the long run?

Kevin Matte OP Keiith : The long-term trend is down, but short-term signals are positive… what does that mean?

It depends on your goal: If you’re a long-term investor, better wait until the stock clearly shows a real recovery (for example, if it breaks above $11.78 with strong volume).

If you’re a short-term trader, you can take advantage of the current bounce, but do it carefully with a stop-loss and clear profit target. In short: short term = possible opportunity / long term = caution until confirmed.

Kevin Matte OP Handiyanan : Are legal issues more serious than competition? Yes, right now, the lawsuits are the bigger concern—they can delay shipments, hurt reputation, and impact cash flow. Competition is more of a long-term risk, but Venture Global is already expanding and signing big contracts to deal with that.

So for now, legal risks are more urgent, but competition is still important over the long run.