No Data

SPXW250430P5655000

- 91.23

- 0.000.00%

- 5D

- Daily

News

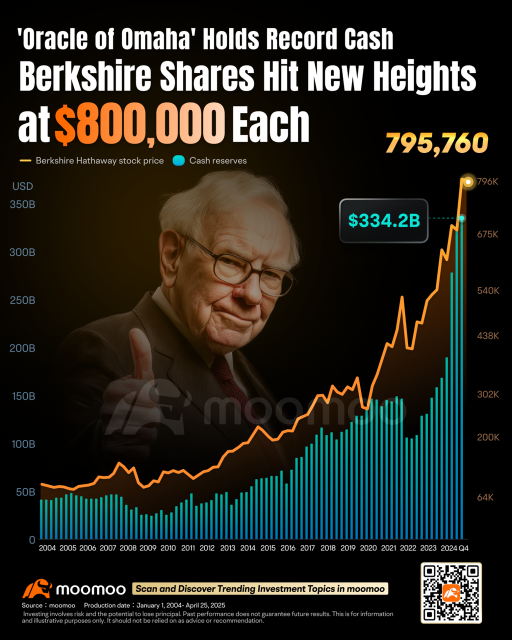

May's Must-See Financial Events: Apple & Nvidia Earnings, Berkshire Meeting, Interest Rate Decision, and More

Express News | China Lifts 125% Tariffs on Some U.S. Goods

Elon Musk Reacts After Ray Dalio Warns Of US Decline, Says China Has Already Surpassed America As Global Consumption Leader

Trader’s Edge (30 Apr 2025) Gains Holds on Wall Street Ahead of Fed, Apple & Meta Earnings; Foreign Funds Flood Back into Bursa

Options Market Statistics: Hims & Hers Stock Surges After Inking Wegovy Deal With Novo Nordisk; Options Pop

Under the shock of tariffs, the Global hedge funds have lost their sense of direction, while shorting the US stock market has become a consensus.

As tariff policies trigger significant market fluctuations, most hedge fund managers choose to stay put, still reluctant to make any major bets, with one notable exception: they are heavily shorting USA Stocks.

Comments

Good start..

$HSI Futures(MAY5) (HSImain.HK)$

$SSE A Share Index (000002.SH)$

$FTSE Singapore Straits Time Index (.STI.SG)$

$Nikkei 225 Index Futures(JUN5) (NKmain.SG)$

$Australia (LIST20803.AU)$

$E-mini NASDAQ 100 Futures(JUN5) (NQmain.US)$

$E-mini Dow Futures(JUN5) (YMmain.US)$

Simon1994 : Breaking through the moving average and going long is quite normal, with a winning rate typically exceeding 70%.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) Only when it falls below 5400 will it turn bearish.

Only when it falls below 5400 will it turn bearish.