No Data

US OptionsDetailed Quotes

SIRI250502P15000

- 0.02

- 0.000.00%

15min DelayClose Apr 29 16:00 ET

0.00High0.00Low

0.02Open0.02Pre Close0 Volume2 Open Interest15.00Strike Price0.00Turnover221.79%IV31.06%PremiumMay 2, 2025Expiry Date0.00Intrinsic Value100Multiplier2DDays to Expiry0.02Extrinsic Value100Contract SizeAmericanOptions Type-0.0140Delta0.0094Gamma1086.50Leverage Ratio-0.0182Theta0.0000Rho-15.24Eff Leverage0.0006Vega

Intraday

- 5D

- Daily

News

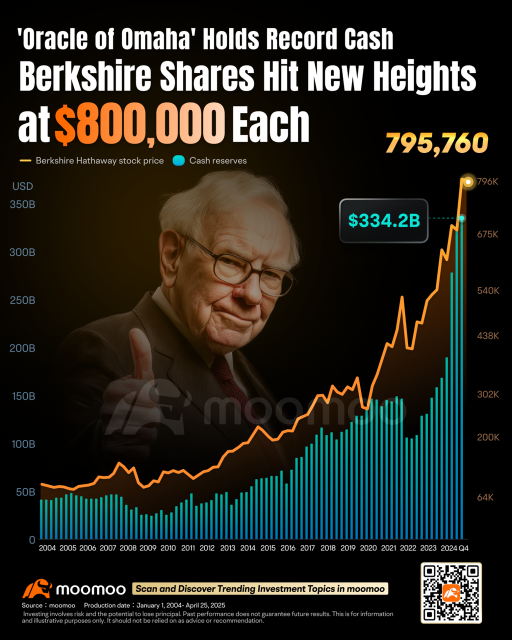

The Berkshire Hathaway Shareholders Meeting is approaching. Here are the three key points that are worth paying attention to.

The Berkshire Hathaway Shareholder Meeting will be held as scheduled from May 2 to May 3, local time.

Berkshire Hathaway Earnings Preview: A Safe Haven Amid the Tariff Storm

Sirius XM to Post Q1 Earnings: What's in the Cards for the Stock?

Morgan Stanley Maintains Sirius XM(SIRI.US) With Sell Rating, Maintains Target Price $21

Earnings Preview: Sirius XM to Report Financial Results Pre-market on May 01

Analysts Have Conflicting Sentiments on These Communication Services Companies: Alphabet Class C (GOOG), Sirius XM Holdings (SIRI) and Comcast (CMCSA)

Comments

$Berkshire Hathaway-B (BRK.B.US)$is about to release its Q1 2025 earnings. According to Zacks data, analysts expect the earnings per share (EPS) to be $4.81, which is a 7.32% decrease from the same period last year. The revenue is projected to be $92.21 billion, showing a 2.6% increase YoY. The average target price set by analysts is $557, while the current share price is $534.57. Based on the analysts' forecasts, this implies...

+5

21

2

13

$Sirius XM (SIRI.US)$ bought long calls. this is the floor on the chart.

$Sirius XM (SIRI.US)$ shag la this useless shit. drop non stop

2

Read more

71426715 : Berkshire Hathaway's upcoming earnings release is set for Saturday, May 3, 2025, after market hours. Given the historical volatility surrounding earnings announcements, investors should be prepared for potential fluctuations. Here's a breakdown of what to consider¹:

- *Earnings History*: Berkshire Hathaway's Q4 2024 earnings report showed a strong beat, with actual EPS of $6.73 versus the consensus estimate of $4.43. Revenue also exceeded expectations, reaching $94.92 billion against an estimated $88.30 billion.

- *Stock Price Movement*: Historically, the stock price has shown significant volatility around earnings releases. The last earnings report resulted in a stronger-than-predicted stock price fluctuation of +4.11% compared to the predicted ±1.98%.

- *Current Market Performance*: As of April 30, 2025, Berkshire Hathaway's stock prices are as follows² ³:

- BRK.B: $534.57 (0.68% change)

- BRK.A: $801,340 (0.45% change)

Considering these factors, I'm cautiously optimistic about Berkshire Hathaway's earnings. The company's diversified portfolio, strong track record of beating earnings estimates, and resilient equity investments could contribute to a positive earnings surprise. However, investors should remain vigilant due to potential market volatility and closely monitor the stock's performance around the earnings announcement.

*Key Takeaways*:

- *Earnings Date*: May 3, 2025, after market hours

- *Potential Volatility*: Historically significant price fluctuations around earnings releases

- *Earnings Expectations*: Analysts estimate Q1 2025 EPS of $5.07, with potential for surprises given the company's track record⁴

sunwu79 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)