US OptionsDetailed Quotes

SIRI250502C32000

- 0.00

- 0.000.00%

15min DelayClose Apr 30 09:30 ET

0.00High0.00Low

0.00Open0.00Pre Close0 Volume0 Open Interest32.00Strike Price0.00Turnover0.00%IV49.92%PremiumMay 2, 2025Expiry Date0.00Intrinsic Value100Multiplier2DDays to Expiry0.00Extrinsic Value100Contract SizeAmericanOptions Type--Delta--Gamma426.90Leverage Ratio--Theta--Rho--Eff Leverage--Vega

Sirius XM Stock Discussion

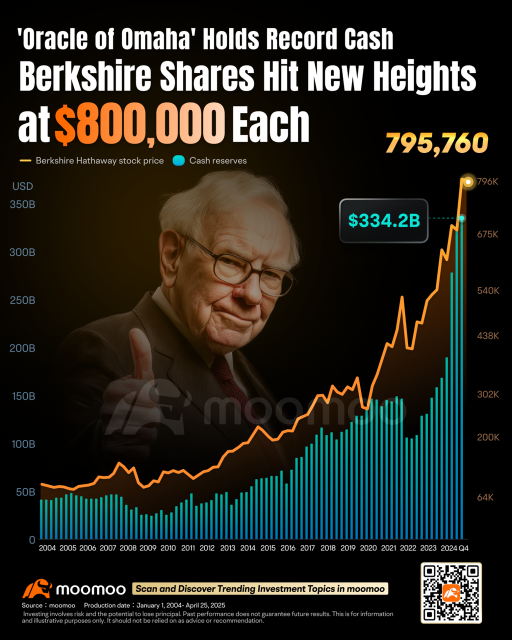

$Berkshire Hathaway-B (BRK.B.US)$is about to release its Q1 2025 earnings. According to Zacks data, analysts expect the earnings per share (EPS) to be $4.81, which is a 7.32% decrease from the same period last year. The revenue is projected to be $92.21 billion, showing a 2.6% increase YoY. The average target price set by analysts is $557, while the current share price is $534.57. Based on the analysts' forecasts, this implies...

+5

31

4

19

$Sirius XM (SIRI.US)$ bought long calls. this is the floor on the chart.

$Sirius XM (SIRI.US)$ shag la this useless shit. drop non stop

2

2

$Sirius XM (SIRI.US)$ this is the most useless stock. Management is pathetic

3

$Sirius XM (SIRI.US)$ pick up my dead body.

2

$Sirius XM (SIRI.US)$ im so mad now why tank today

No comment yet

71426715 : Berkshire Hathaway's upcoming earnings release is set for Saturday, May 3, 2025, after market hours. Given the historical volatility surrounding earnings announcements, investors should be prepared for potential fluctuations. Here's a breakdown of what to consider¹:

- *Earnings History*: Berkshire Hathaway's Q4 2024 earnings report showed a strong beat, with actual EPS of $6.73 versus the consensus estimate of $4.43. Revenue also exceeded expectations, reaching $94.92 billion against an estimated $88.30 billion.

- *Stock Price Movement*: Historically, the stock price has shown significant volatility around earnings releases. The last earnings report resulted in a stronger-than-predicted stock price fluctuation of +4.11% compared to the predicted ±1.98%.

- *Current Market Performance*: As of April 30, 2025, Berkshire Hathaway's stock prices are as follows² ³:

- BRK.B: $534.57 (0.68% change)

- BRK.A: $801,340 (0.45% change)

Considering these factors, I'm cautiously optimistic about Berkshire Hathaway's earnings. The company's diversified portfolio, strong track record of beating earnings estimates, and resilient equity investments could contribute to a positive earnings surprise. However, investors should remain vigilant due to potential market volatility and closely monitor the stock's performance around the earnings announcement.

*Key Takeaways*:

- *Earnings Date*: May 3, 2025, after market hours

- *Potential Volatility*: Historically significant price fluctuations around earnings releases

- *Earnings Expectations*: Analysts estimate Q1 2025 EPS of $5.07, with potential for surprises given the company's track record⁴

sunwu79 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

101775147 AL pyen :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

101775147 AL pyen 71426715 : slow