US Stock MarketDetailed Quotes

PDD PDD Holdings

- 110.920

- +4.950+4.67%

Close May 2 16:00 ET

- 111.190

- +0.270+0.24%

Post 20:01 ET

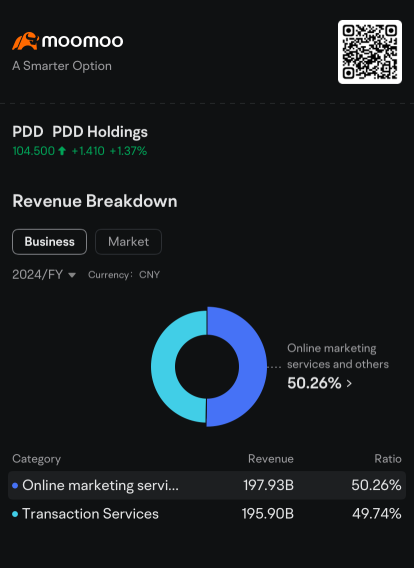

157.47BMarket Cap10.61P/E (TTM)

111.605High109.085Low9.15MVolume109.900Open105.970Pre Close1.01BTurnover1.22%Turnover Ratio10.61P/E (Static)1.42BShares164.69052wk High3.65P/B82.94BFloat Cap87.11052wk Low--Dividend TTM747.77MShs Float212.597Historical High--Div YieldTTM2.38%Amplitude16.530Historical Low110.475Avg Price1Lot Size

PDD Holdings Stock Forum

we have to broadly look at the Great Organisation of Global Supply Chain and Cold War 2.0, as a managed contingency plan to China's collapse, which will happen inevitably as the downward trend is increasing clear with increasing evidence.

if you look at it as an instalment plan to reduce the pain instead of having a chronic shock at one go, it will make sense.

"If China were to collapse suddenly in a manner similar to the Soviet Union’s dissolution, the impact on gl...

if you look at it as an instalment plan to reduce the pain instead of having a chronic shock at one go, it will make sense.

"If China were to collapse suddenly in a manner similar to the Soviet Union’s dissolution, the impact on gl...

3

10

$SPDR S&P 500 ETF (SPY.US)$

$Alibaba (BABA.US)$ $PDD Holdings (PDD.US)$

so the internet went wild over CIA's Mandarin video seeking to recruit spies from China.

MSN

- YouTube

- YouTube

this is the incoming Cultural/Propaganda War that I mentioned last year.

is CIA really recruiting spy from China using social media? Not really.

CIA already has a very good infiltration into PLA, particularly the Rocket Force, that's why the reveal of their manpower structure shook Xi to ...

$Alibaba (BABA.US)$ $PDD Holdings (PDD.US)$

so the internet went wild over CIA's Mandarin video seeking to recruit spies from China.

MSN

- YouTube

- YouTube

this is the incoming Cultural/Propaganda War that I mentioned last year.

is CIA really recruiting spy from China using social media? Not really.

CIA already has a very good infiltration into PLA, particularly the Rocket Force, that's why the reveal of their manpower structure shook Xi to ...

1

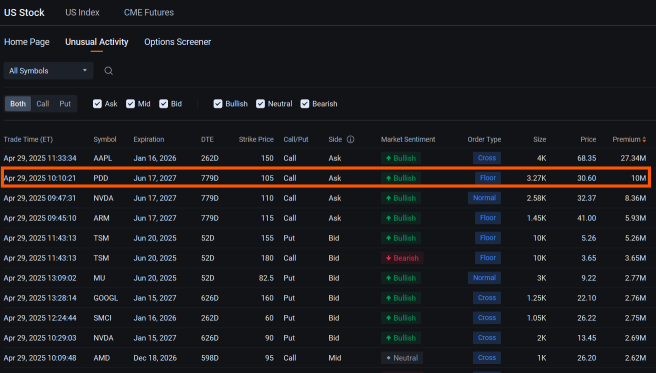

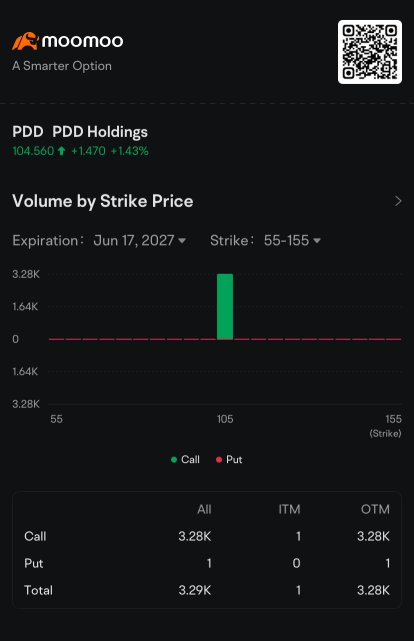

$PDD Holdings (PDD.US)$ attracted the second biggest block trade in options Tuesday at a time when the Chinese e-commerce platform is mired in a trade war between the U.S. and China.

At 10:10:21 a.m., a bullish block trade was posted involving an active buyer paying a $10 million premium for call options that give the holder the right to buy 327,000 of PDD’s American depositary shares (ADSs) at $105 each in 779 days. T...

At 10:10:21 a.m., a bullish block trade was posted involving an active buyer paying a $10 million premium for call options that give the holder the right to buy 327,000 of PDD’s American depositary shares (ADSs) at $105 each in 779 days. T...

19

4

4

$PDD Holdings (PDD.US)$ fill the gap!!!

1

very few Western academics is able to understand CCP as thoroughly as this guy.

today's Trump's Cold War 2.0 is a direct result of CCP's ambition to rule the world with its evil system.

- YouTube

$PDD Holdings (PDD.US)$ $JD.com (JD.US)$ $Alibaba (BABA.US)$ $SPDR S&P 500 ETF (SPY.US)$

today's Trump's Cold War 2.0 is a direct result of CCP's ambition to rule the world with its evil system.

- YouTube

$PDD Holdings (PDD.US)$ $JD.com (JD.US)$ $Alibaba (BABA.US)$ $SPDR S&P 500 ETF (SPY.US)$

4

7

$PDD Holdings (PDD.US)$

New at trying to understand flow. Can anyone explain why a put option in the money like this one worth 9Ms is considered bullish? Thanks.

New at trying to understand flow. Can anyone explain why a put option in the money like this one worth 9Ms is considered bullish? Thanks.

1

$PDD Holdings (PDD.US)$Moomoo Welcome Bonus

1

First, let's state the conclusion:

Tesla's performance clearly caught both bulls and bears off guard. What's better than expected is that Musk indeed revealed a reduction, which is consistent with the overall viewpoint in the article I wrote last week. $Tesla (TSLA.US)$

If President Trump wishes, he would still spend 'one or two days' a week handling government affairs, but he will allocate more time to Tesla

After all, Tesla is currently faci...

Tesla's performance clearly caught both bulls and bears off guard. What's better than expected is that Musk indeed revealed a reduction, which is consistent with the overall viewpoint in the article I wrote last week. $Tesla (TSLA.US)$

If President Trump wishes, he would still spend 'one or two days' a week handling government affairs, but he will allocate more time to Tesla

After all, Tesla is currently faci...

+6

54

9

6

$PDD 250502 100.00C$ call

2

2

$PDD Holdings (PDD.US)$ dropping

1

No comment yet

Hoopski : If China collapses, where would Tesla get their precious minerals to make their cars from ??

Yan Zhang8 Hoopski : China is everywhere, just as a factory.

SKYWalkers OP Hoopski : Japan, since 2010/2013, I have to check back on my research, they already started rare earth stockpiling.

P.S. 2010, there was a Japan ministry document, I can't find it now.

https://www.weforum.org/stories/2023/10/japan-rare-earth-minerals/

MOHD NOR B ABDULLAH : It is very difficult to predict, it is impossible for it to happen

SKYWalkers OP MOHD NOR B ABDULLAH : it's not difficult to predict, economic collapse is inevitable, it's only a matter of time, when specifically, nobody can say for sure, but there are scholars who estimate 5 to 8 years, at the current rate of demise, so when the situation is desperate, you can see unusual activities from CCP.

"There is no precise date or universally agreed timeline for when China might reach a so-called "point of no return," as this depends on how you define that point—whether as economic stagnation, debt crisis, political instability, or geopolitical isolation. However, we can assess some key risk factors that could push China toward long-term structural decline if left unresolved:

1. Demographic Cliff (Peak Labor Force)

Fertility rate: ~1.0–1.2 (far below replacement)

Working-age population: Shrinking rapidly

Projection: By 2030–2035, China may face severe labor shortages, higher pension burdens, and slowing productivity.

2. Property and Debt Crisis

The real estate sector contributes ~25–30% of GDP.

Developers like Evergrande and Country Garden have defaulted.

Local government financing vehicles (LGFVs) are heavily indebted.

Point of concern: If defaults continue without reform, a financial or local government funding crisis could erupt by 2026–2028.

3. Innovation and Technology Decoupling

U.S.-led export controls (on semiconductors, AI chips, etc.) are beginning to bite.

Domestic firms are under pressure to achieve self-sufficiency in key sectors.

If decoupling accelerates without successful innovation, tech stagnation could set in by 2030.

4. Political Rigidity under Xi Jinping

Centralization of power and crackdown on private sector (e.g., Jack Ma, Ant Group)

Less room for policy experimentation

If political rigidity suppresses economic reform, China's growth model could stall permanently by the late 2020s.

Conclusion: Likely Timeline for "Point of No Return"

If major reforms are not enacted:

2026–2030: High risk of entering a “middle-income trap” scenario with prolonged low growth

2030–2035: Risk of economic stagnation becoming irreversible due to demographics, debt, and weak productivity."

View more comments...