No Data

IAUM ISHARES GOLD TRUST MICRO

- 33.022

- -0.098-0.30%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

The inflation Indicator most valued by the Federal Reserve continued to cool in March, but the "Trump impact" has arrived.

Data released on Wednesday indicated that the core PCE price Index in the USA experienced a slight month-on-month decline in March, the first decline since 2020; however, with a series of tariffs coming into effect, the market generally expects inflation in the USA to rise in the coming months; this will also put the Federal Reserve in a dilemma.

USA's inflation unexpectedly "stalled" in March, and the economic 'breathing space' may not last.

On the eve of the official implementation of tariffs, mixed data has emerged from the USA economy.

"The rush to import has caused the USA economy to shrink for the first time since 2022: the initial value of Q1 real GDP annualized was -0.3%, and core PCE at 3.5% is the highest in a year.

Affected by the surge in imports before tariffs and weak Consumer spending, the USA economy declined by 0.3% in the first quarter, with imports hitting the largest increase in five years, net exports dragging down GDP by nearly 5 percentage points, government spending experiencing negative growth for the first time since 2022, and business equipment spending being almost the only highlight.

Base Metal Prices Fall on Stronger Dollar, Gloomy Economic Outlook -- Market Talk

Weak U.S. Data Could Benefit Dollar If It De-Escalates Trade Conflict -- Market Talk

The non-farm payrolls are coming in strong! If cracks begin to show in the USA labor market, the likelihood of the Federal Reserve lowering interest rates in June is expected to increase significantly.

The shadow of tariffs looms over the USA economy, with top Wall Street investment institution Apollo Global Management warning that Friday's non-farm report may highlight signs of weakness in the labor market.

Comments

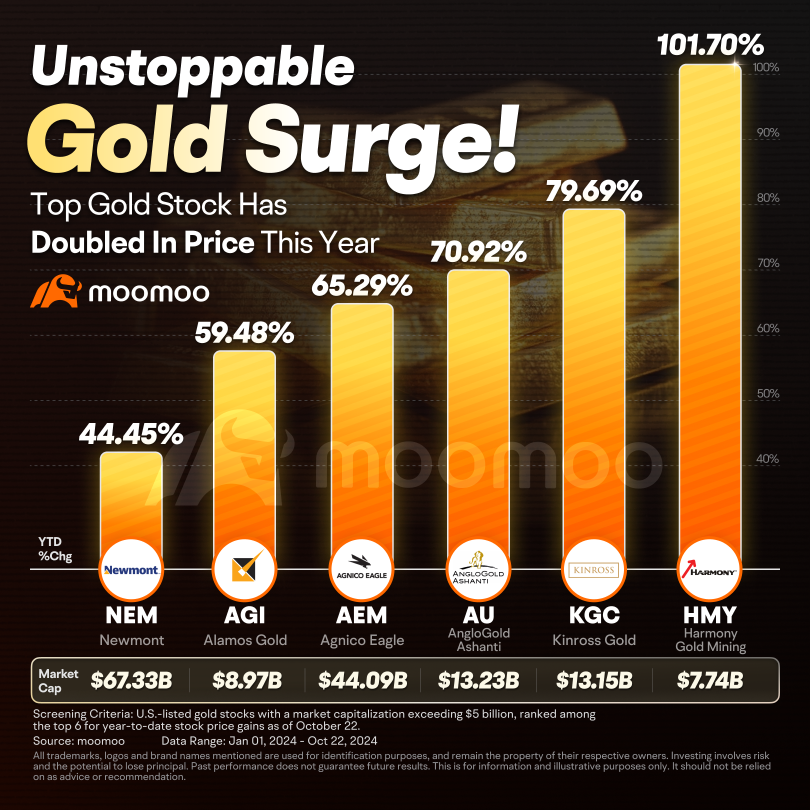

is a chance to dive into the rolling 25-year performance of Gold vs. the S&P 500 since 1978.

But here’s the kicker: no single asset class, especially not Gold, is your golden ticket to investment success. Since 1978, over any rolling 25-year period, gold has only just edged out the S&P 500 when you cherry-pick starting at the Dotcom crash and includes the GFC an...

On October 19, 1987, the Dow Jones Industrial Average (DJIA) fell 508.32 points, a decline of 22.61 percent, ending a bull market that had lasted since August 1982. A record volume of 604.33 million shares traded hands that day, three times the daily average. The New York Stock Exchange (NYSE) lost more than US$500 billion in market capitalization, its largest loss since the beginning of World War I in 1914. The DJIA’s colla...

Additionally, the white line comparing Gold vs. S&P 500 indicates a potential turnaround after a prolonged period of underperformance. Could the recent outperformance by gold signify the start of...

Buy n Die Together❤ :

Svetlana Polishuk :